How to Buy Life Insurance

Choosing the right type of life insurance policy and its death benefit can be confusing. Not too long ago, I published a guest post from Baruch Silverman of The Smart Investor on the different types of life insurance. In this post, you'll learn how to buy life insurance. Specifically, I’ll help you evaluate which, if any, of those types of policies fit your situation and how to select your death benefit.

Why are You Buying It?

The first thing you want to consider is why you are buying life insurance. Three common purposes are:

the death benefit.

the investment returns.

sheltering gifts to your heirs from income taxes.

Death Benefit

If your primary purpose for purchasing life insurance is the death benefit, you’ll want to focus on term and whole life insurance.

Investment Portfolio

Some people use life insurance similar to other financial securities (such as stocks and bonds). Variable life and universal life have investment components to them. In simplified terms, the total amount you pay as premium for these types of life insurance is split between the amount to cover the cost of a whole life policy and the excess which can be invested. As such, the life insurer doesn't invest the portion of the premium related to the death benefit. Further, the life insurer reduces the excess to cover its expenses, a risk charge, and its profit margin before investing it.

Variable and universal life policies include the cost of whole life insurance. Thus, only people who want the coverage provided by whole life insurance might consider using life insurance as part of their investment portfolio. Even then, the returns may not be as high as other investment vehicles with similar risk because of the additional costs charged by the life insurer.

Tax Shelter

Sheltering gifts to your heirs from income taxes only applies to the very wealthy (those who have more than $11 million in assets). I’m assuming that the vast majority of my readers aren’t in this situation, so won’t address it here.

Other Considerations

All types of life insurance can have an indirect impact on your investment portfolio. If you purchase life insurance in an amount that will cover your dependents’ basic living expenses, it allows you the option to invest your portfolio in riskier assets in anticipation of getting higher returns. That is, the death benefit itself could be considered a low-risk investment. It reduces your overall portfolio risk when added to the other assets you own.If you are more concerned about outliving your savings, annuities can protect against the opposite risk from life insurance. Certain types of annuities provide a stream of income from a stated start date until you die. If you are concerned about this risk, this post about annuities might help.

Do I Need Life Insurance?

Some people don’t need the death benefit from life insurance. In that case, it doesn’t make sense to buy life insurance as an investment security either. In the last section of this post, I provide the details of estimating your target death benefit. People whose target death benefit is zero are those who don’t need life insurance. Briefly, characteristics of people who have a target death benefit of zero are:

Their available assets are more than their debts. Available assets exclude any illiquid assets (such as any real estate or personal property they own), savings for their dependents' retirement (but not their retirement as they don't need retirement savings after you die), emergency savings and any savings designated for large purchases.

They have enough money to cover their dependents’ education expenses.

Their dependents can support themselves on their existing income plus your available assets, including being able to make debt payments as they are due or after using available assets to pay off any debts.

They have enough money to pay any end-of-life expenses related to their death.

If you aren’t sure if you meet these criteria, keep reading!

Term vs. Whole

If you’ve decided that you are buying life insurance for the death benefit, you need to decide whether term life or whole life insurance will better meet your needs. The primary differences between the two options are the length of time you need the insurance and the cost.

Term Life

If you think you will need life insurance for a limited period of time, term life insurance is likely better for you. For example, you might have dependents who aren’t currently able to cover their living expenses and the cost of any debt. In that case, you might want to buy life insurance that will pay off your debts and support your dependents until they are independent. If your needs change, many insurers will let you convert a term life insurance policy to a whole life policy without having to provide medical information or have a physical, one or both of which are often prerequisites for purchasing whole life insurance.Term life premiums are constant over the term of any policy you purchase. However, if you buy a policy when you are older, the premium will be higher than if you buy the same policy when you are younger.

Whole Life

If you think you will need life insurance for your entire life, whole life insurance is likely better for you. For example, if you have a spouse or disabled children who will never be able to support themselves, whole life insurance could supplement your savings to help make sure they are able to live more comfortably, regardless of when you die.In addition to the death benefit, whole life insurance gives you the option to borrow money. As you pay premium, life insurers designate a portion of your premium as the cash value. The cash value is always owned by the insurance company, but you are able to borrow an amount up to the cash value at any time without prior approval, any collateral or impact on your credit score. The interest rates on cash-value loans are less than many other sources, particularly credit cards. If you die before the loan is re-paid, the amount of the loan will be deducted from your death benefit.

Cost Comparison

Whole life insurance is much more expensive than term life when you are young, but eventually becomes less expensive.

Probability of Dying

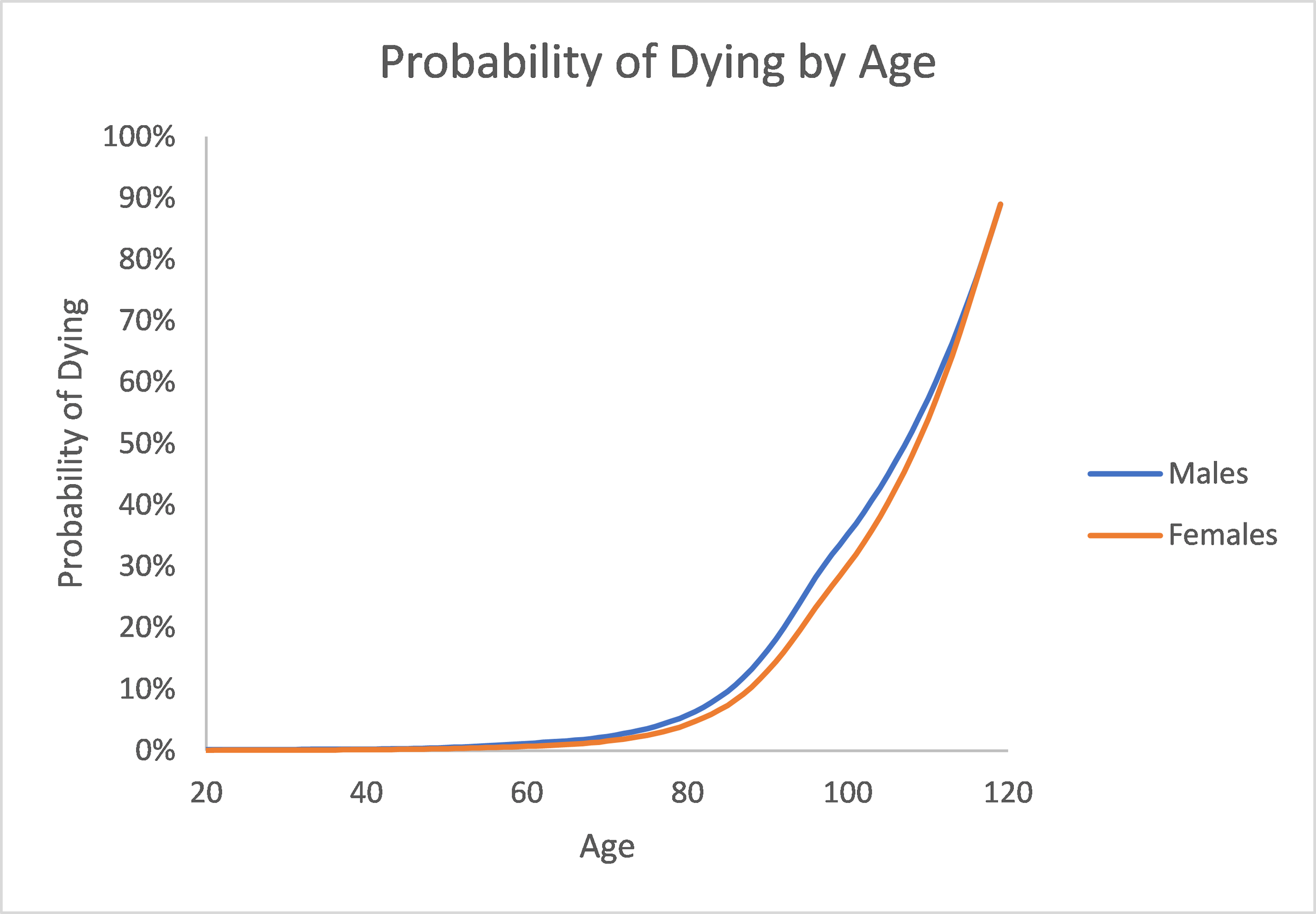

The graph below provides some initial insights into the difference in cost between whole life and term life, as it shows the probability that you will die at each age. I calculated the values based on 2016 data from the Social Security web site.

Not surprisingly, the probability you will die increases at each age. If you buy whole life insurance, it will cover the entire portion of the graph from your current age until you die. As such, there is a 100% probability that the life insurer will pay your death benefit (assuming you continue to pay your premiums). It is just a question of when.

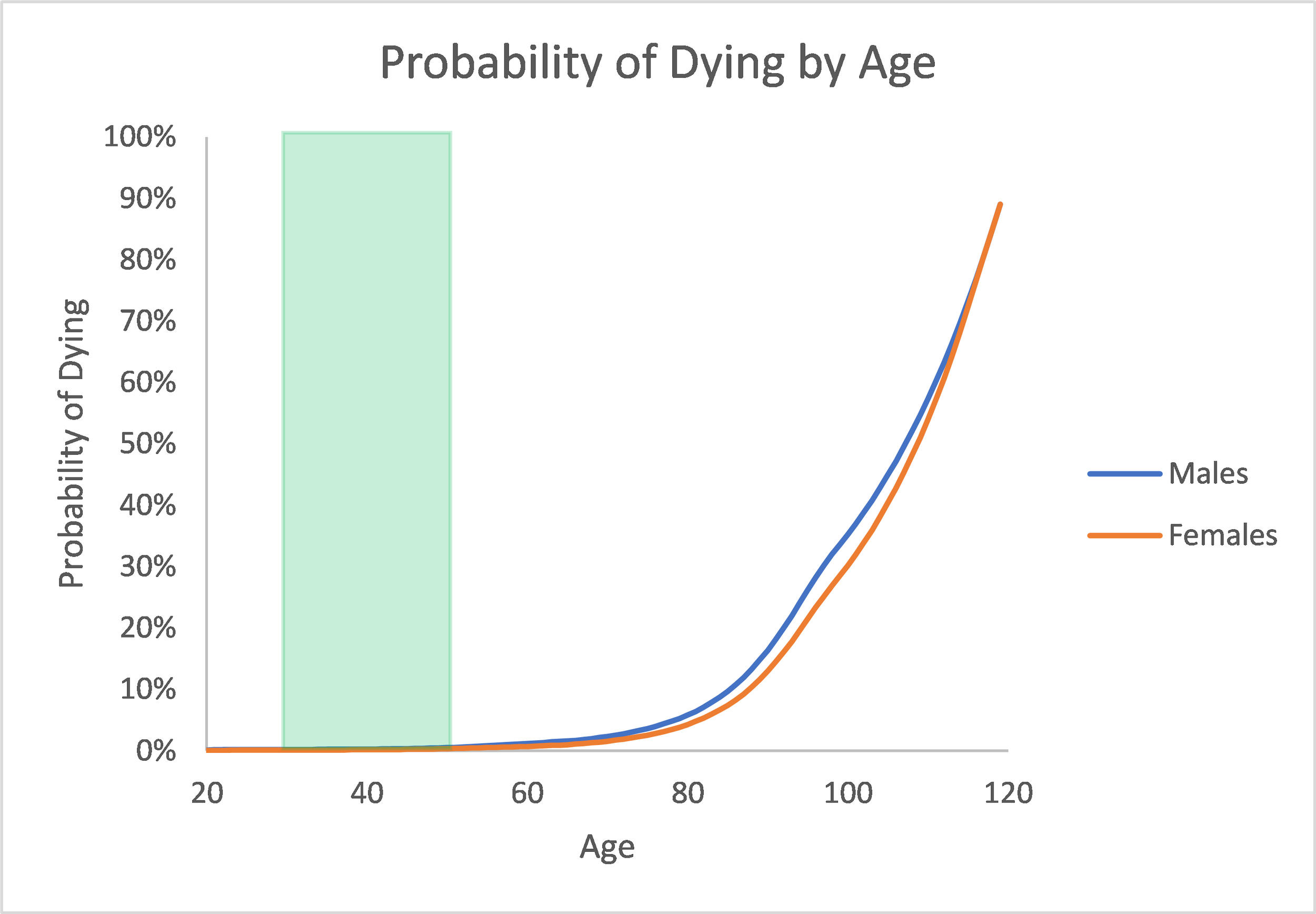

If you buy a 20-year term policy and you are 30 years old, only the deaths that occur in the portion of the graph below highlighted in green would be covered. That is, you will receive the death benefit if you die between ages 30 and 50 and will get nothing if you die after age 50.

The probability you will die is much smaller in this narrow window than the 100% probability you will die at some point.

Present Value of the Death Benefit

There are many factors that determine the premium for term life and whole life insurance policies, but the most important component relates to the death benefit. Actuaries (who help price life insurance) usually base the portion of premium related to the death benefit as the present value of the death benefit expected to be paid, on average, in each year.

One-Year Term Policy

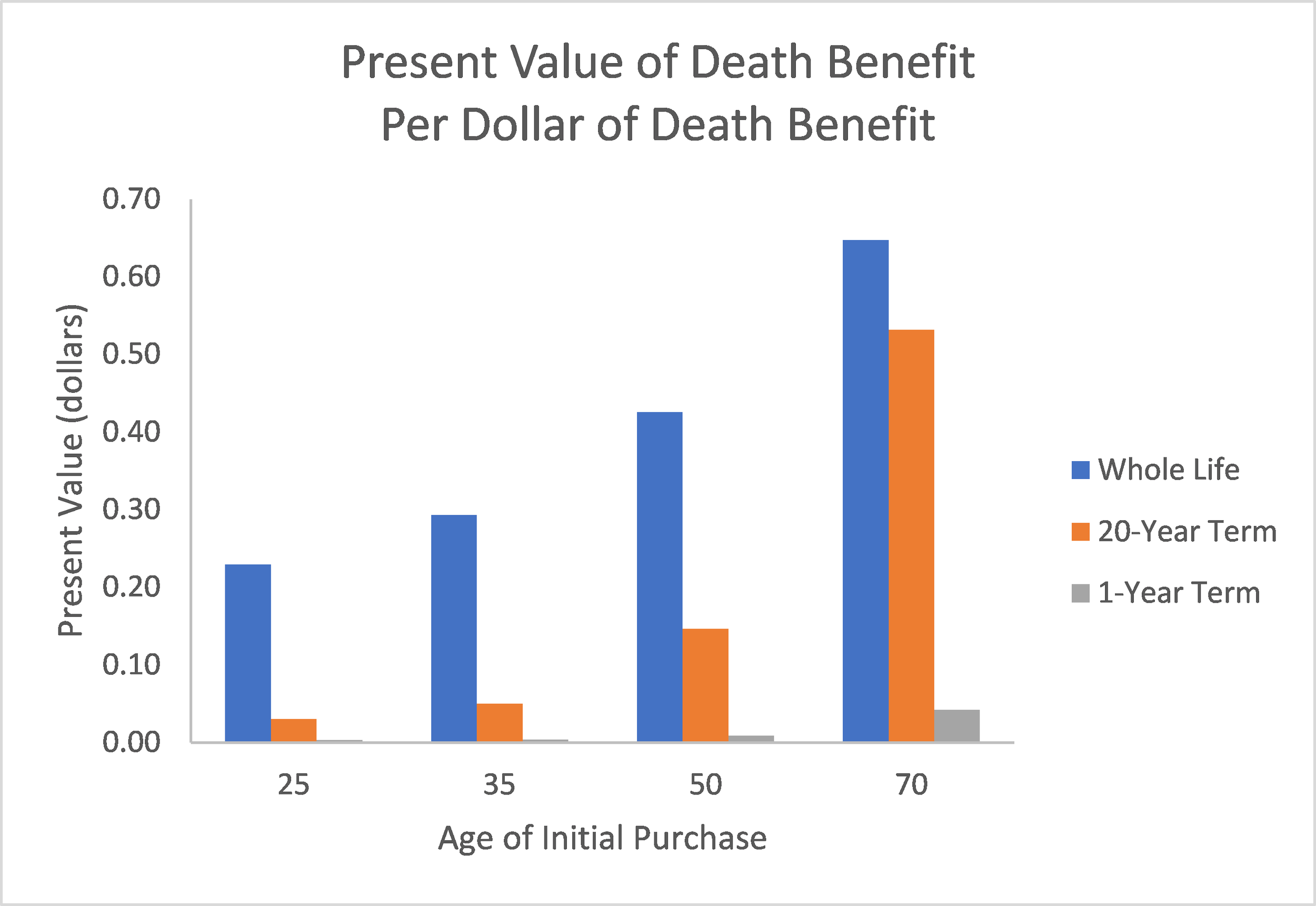

The chart below shows the present value for $1 of death benefit for several sample policies. For illustration only, I have calculated the present values using a 3% interest rate and the probabilities of dying from the charts above.

The easiest way to see the impact of the increasing probability of dying is to look at the present value of the death benefit for a 1-Year Term Life policy. You can see it increases from almost zero (actually $0.0015 per dollar of death benefit) at age 25 to $0.042 per dollar of death benefit at age 70 which corresponds exactly to the increase in the probability of dying at each age.

Policies with Longer Terms

There are also increases in the present value of the death benefit for the Whole Life and 20-Year Term Life policies as the age you first start buying the policy increases. You can also see that the present value of the death benefit at age 25 for the Whole Life policy is much, much larger than the present value for either of the two term life policies. This relationship corresponds to the graphs above which compared the probability of dying in a 20-year period as compared to the 100% probability that you will die at some point.

The difference between the Whole Life and 20-Year Term Life policies is fairly small at age 70, because there is a high probability that you will die between age 70 and 90 – the period covered by the 20-Year Term Life policy. In fact, almost 80% of people age 70 will die during the 20-Year Term Life policy period. As such, the present value of the death benefit for a 20-Year Term Life policy at age 70 is very roughly 80% of the present value of the death benefit for a Whole Life policy.

Annual Premium

The insurance company collects premium over the full life of the insurance policy to cover the present value of the death benefit. That is, you don’t pay all of your premium to the insurance company in one lump sum, but rather on an annual or monthly basis.Unless you die during the policy term of the Term Life policy, you will pay premium for more years under a Whole Life policy than under a Term Life policy. Therefore, the differences you see above are larger than the differences in premium payments.

Illustration

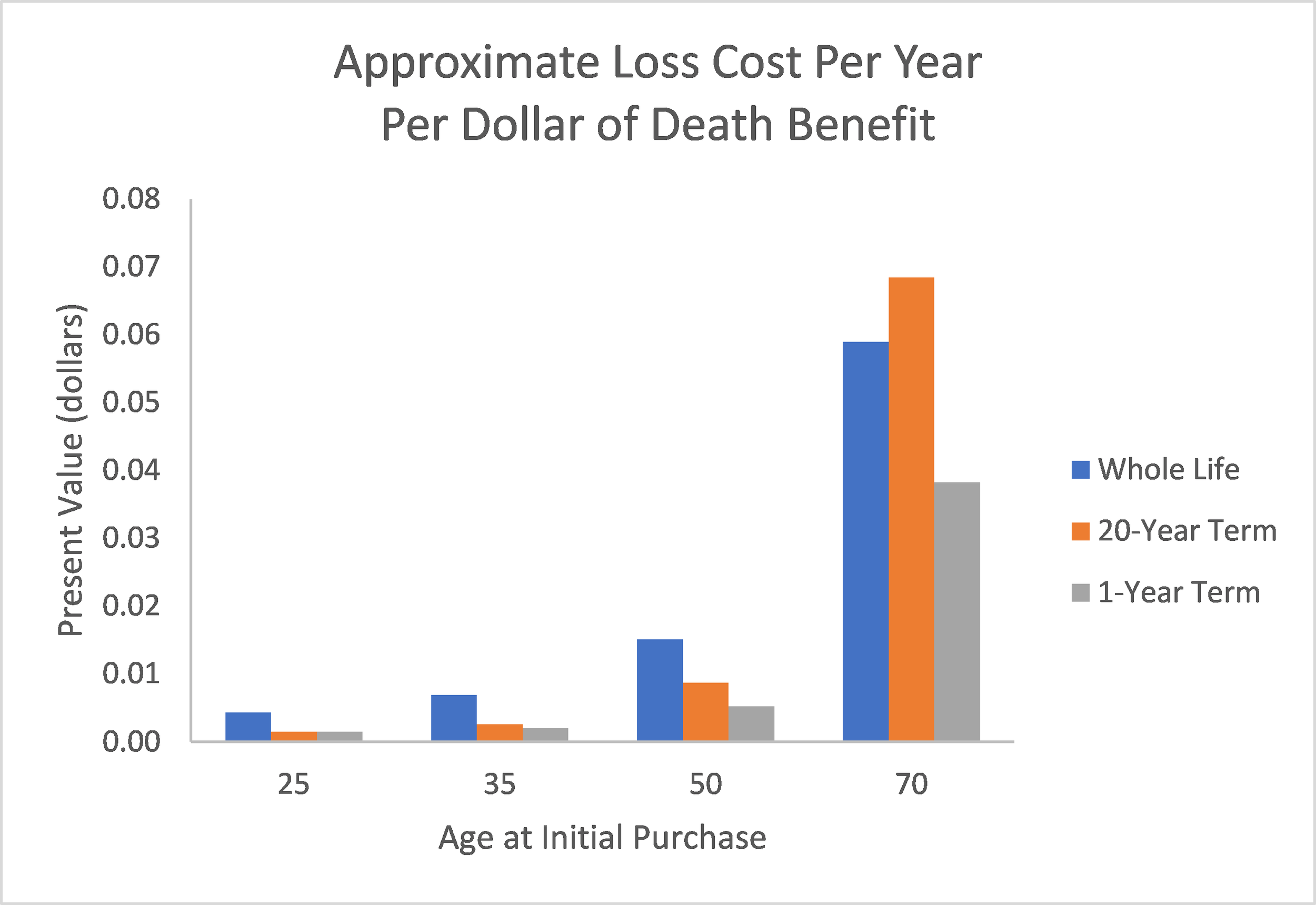

The chart below shows the annualized amount of the loss costs. That is, I divided the present values of the death benefits by the average number of years an insured is expected to pay their premium. For example, for the 20-Year Term Life policy, the denominator was calculated as the sum of the probabilities that the insured would be alive in each of the 20 years and therefore able to pay his or her premium.

Although these relationships are not precise, they are roughly representative of the differences in annual premium you might pay for the different types of policies at different ages. At age 25, the annual cost of a Whole Life policy in this illustration is roughly three times the cost of either of the Term Life policies. By age 70, the annual cost of a Whole Life policy is less than the cost of 20-Year Term Life policy because, while the present value of the death benefit isn’t all that different between the two policies, people who buy Whole Life policies make more premium payments, on average.

Reality vs. Illustration

It is important to understand that I prepared these examples as illustrations to help you understand the differences between Whole Life and Term Life insurance premiums. In practice, life insurers use different tables showing the probability of dying and different interest rates than I used for illustration, as well as using more sophisticated methods for calculating the present value of the death benefit and including provisions for expenses, risk and profit.

In practice, I’ve seen estimates that Whole Life annual premiums are anywhere from three to fifteen times more than Term Life premium at young ages. As you are looking at your options, you’ll want to get several premium quotes, as they vary widely depending on your age, location, gender, health and many other factors.

How Much to Buy

As with any financial decision, there are two conflicting factors that will influence the amount of the death benefit you buy on a life insurance policy – your budget and your financial needs. In the section, I will talk about how to estimate the best (i.e., target) death benefit for your situation. Once you’ve selected an amount, you can get quotes from several insurers to see whether the premium for that death benefit will fit in your budget or whether you will need to find the best balance between premium affordability and death benefit for you.

Rules of Thumb

Not surprisingly, there are some rules of thumb for guiding your selection of a death benefit. Some of the ones I’ve heard are:

Three to five times your salary

Ten times your total earned income (i.e., salary, value of benefits and bonus)

Ten times your total earned income plus $100,000 per child for college

Rules of thumb like these can provide some insights, but they, by definition, can’t take into account your personal circumstances.

Tailored Approach

A better approach for selecting a death benefit is to analyze your own finances and goals for buying life insurance. I suggest calculating your target death benefit as the total of the amounts needed to meet your goals, considering the following components.

Debt

If you have debt, you’ll want to consider whether your dependents will be able to continue to make the payments on the debt out of their own income. For example, if your spouse’s earned income is high enough to continue to make your mortgage payments, along with all of the other expenses he or she will need to cover if you die, then you might not need to include the remaining principal on your mortgage as a component of your target death benefit. On the other hand, if you are concerned about your dependents’ ability to continue payments on any debt, you’ll want to include the outstanding principal on those debts as a component of your target death benefit. I’ll define this amount as “Debt Principal to be Prepaid.”

Final Expenses

When you die, your dependents will incur some one-time expenses. These expenses can include your funeral or memorial costs and professional expenses to settle your estate. I’ll call the amount of these expenses, “Final Expenses.”

Net Future Living Expenses

The next component of your target death benefit calculation is the amount you need to cover your dependents’ future living expenses.

Current Expenses

Start with your household’s total expenses from your budget. This amount will include monthly expenses for everyone in your household, the amounts you are setting aside each month for your designated savings and any amounts you are setting aside for your spouse’s retirement. To be clear, it will exclude any amounts you are saving for your own retirement.

You can eliminate any monthly expenses or amounts for designated savings for things that are only for your benefit. For example, if you spend enough money on clothes for your job to include it in your budget, you can eliminate those expenses. Similarly, you can also eliminate any expenses related to a vehicle that only you drive or designated savings to replace it.

Earned Income

You then need to calculate your dependents’ monthly earned income. This amount may be calculated in two parts – current monthly earned income and future monthly earned income. For example, your spouse may currently work part time as you are relying primarily on your income for support. If you die, your spouse may be able to work full time to increase his or her earned income. Alternately, your spouse may need some education (discussed below) to get the qualifications needed for his or her desired profession.

Extra Expenses

Next, you’ll need to calculate the amount of any expenses that your household will have because of any changes in your spouse’s availability to provide household services. For example, your spouse may work part-time while your children are in school and provide childcare after school. If your spouse starts working full time after your death, you will need to add after-school care expenses to your budget.

Time Periods

The last factor that goes into this calculation is the length of time until you think your dependents will become self-sufficient. For children, you might assume that they will become independent after they turn 18 or graduate from college. The ability of your spouse to become self-sufficient will be a function of his or her skills, education and/or need for more education and household responsibilities (e.g., childcare or elder care).I suggest splitting the calculation of this component of your death benefit into three time periods – short-term, medium-term and long-term. For each time period, you’ll calculate your net living expenses as expenses minus income. For any periods for which income is more than expenses, set the difference to zero.

Short term – During this time period, you’ll use your current monthly expenses, excluding your personal expenses, and your dependents’ current monthly earned income.

Medium term – During this time period, you’ll use your current monthly expenses with adjustments for extra expenses for services currently provided by your spouse and your dependents’ future monthly earned income.

Long term – During this time period, you’ll assume that your children (other than those who will always be dependent on you for care) are self-sufficient, so can eliminate all expenses related to children and their care from your expenses. You’ll use your spouse’s future monthly earned income. In many households, income in this period will exceed expenses so there may not be a need for death benefits to cover expenses in this period.

You also need to estimate how many months each of these three time periods will last.

Net Future Living Expenses

Your Net Future Living Expense amount for each time period is calculated as the number of months it will last multiplied by monthly net living expense amount. You can then calculate your total Net Future Living Expenses as the sum of the three amounts you calculated for the three time periods.

For those of you who like to see formulas instead of words, you will calculate:

Short-term Net Expenses = Greater of 0 and Current Expenses – Current Income

Medium-term Net Expenses = Greater of 0 and Current Expenses + Extra Expenses – Future Income

Long-term Net Expenses = Greater of 0 and Future Expenses – Future Income

Net Future Living Expenses = (number of months in short-term period x Short-term Net Expenses) + (number of months in medium-term period x Medium-term Net Expenses) + (number of months in long-term period x Long-term Net Expenses)

You could refine this amount by considering inflation and investment returns. Depending on your investment strategy and the time until the funds are used, your investment returns, on average, can be more than inflation. As a conservative first approximation, I suggest using the total without adjustment for inflation and investment returns.

Education

There are two types of education expenses that you might want to include in your target death benefit calculation:

The portion of the cost of education for your children that you want to provide. Some people suggest $100,000 per child for college. This amount may or may not be the right amount depending on how much you expect your children to contribute to their educations, how many years of college education you want to support and what type of school they attend. Prestigious colleges can cost as much as $75,000 to $80,000 a year currently (2020), while in-state tuition (assuming your children live at home while attending college) can cost as little as $15,000 a year in some states. Other children may not go to college or may attend a trade school.

The cost of any education your spouse needs or wants to allow him or her to work in a profession he or she enjoys and allows him or her to earn enough money to increase his or her independence.

Target Death Benefit Calculation

You can now calculate your target death benefit as follows:

Debt Principal to be Prepaid

Plus Final Expenses

Plus Net Future Living Expenses

Minus Savings in excess of your real estate and personal property assets, emergency fund, designated savings and spouse’s retirement savings

Plus Education Expenses

Minus Amounts in existing college funds

Minus Any amounts included in your Net Future Living Expenses designated for college

If you are single with no debt, this amount could be zero indicating that you might not need to buy life insurance. If you are married with no children, don’t have a lot of debt and have a spouse who can increase income or decrease expenses to be self-sufficient fairly quickly, you may need only a small death benefit. At the other extreme, if you have several children and a spouse who won’t be able to be financially independent for many years or ever, your target death benefit could exceed $1 million. As you can see, the specifics of your financial situation are very important to setting a target death benefit and a rule of thumb may not work for you.