Social Security: How Much Will I Get in Retirement

Social Security is a key pillar in most American’s retirement plans, especially those approaching retirement. Many younger workers, though, have serious concerns about whether they will receive any benefits at all. Even at current levels, Social Security benefits are not enough to support most people. Understanding what impacts your Social Security benefits and how much you might get, whether you plan to retire soon or not for many years, are important components in determining how much money you’ll need to save.

Key Take-Aways

Here are the key take-aways from this post. I’ll discuss these points in greater detail below.

While it is likely you will be able to collect some Social Security benefits when you retire, regardless of your age, the current combination of Social Security tax rate, benefit levels and normal retirement age is unsustainable. It will not be possible to pay benefits at current levels starting in roughly 2034 unless there is one or more of (a) an increase in the Social Security tax rate, (b) an increase in the wages subject to the Social Security tax, (c) a decrease in benefits or (d) a delay in the normal retirement age.

If you retire soon and start collecting your Social Security benefits at your normal retirement age (67 for most of you), they will replace between roughly 15% and 50% of your ending salary, with those of you making more money getting a higher dollar amount but a lower percentage of your ending salary.

You can start collecting benefits any time between your 62ndand 70th birthdays. The longer you wait, the higher your monthly benefit. If you could be sure that you were going to die before you were between roughly 80 and 82, you would likely be better off collecting benefits at age 62. Otherwise, you are better off delaying the start of your benefits.

Knowing how much you are likely to get in Social Security benefits is an important component of figure out how much you need to save for retirement and therefore how much you need to save each year.

How Likely Am I to Collect Benefits?

The most recent report from the Social Security Administration covers actual results through 2017. In 2018, benefits and expenses paid under Social Security were expected to exceed total revenues for the first time in many years. Revenue to the Social Security system comes from taxes paid by employees and employers and from interest and principal from the Social Security Trust Fund. Under middle-of-the-road assumptions, the Trust Fund is estimated to be depleted in 2034.

Changes in Birth Rates

The decreases in the Trust Fund are due in large part to the birth patterns in the US, along with the lengthening of life expectancies. Currently, the baby boom generation is receiving benefits and the “baby bust” generation and its employers are paying taxes. The graph below shows the number of births in the US by year[1] and, specifically, the numbers of births during the baby boom and baby bust time periods.

Contributors vs. Beneficiaries

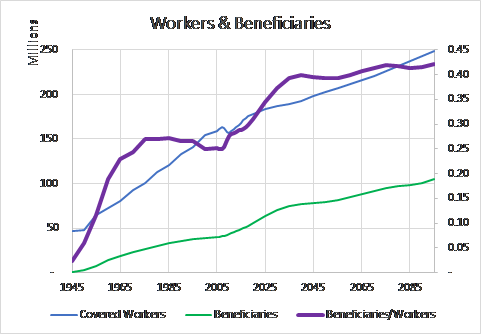

The graph below shows the number of workers paying social security taxes and the number receiving benefits.

The green line (beneficiaries) goes up faster than the blue line (covered workers). The ratio of the number of beneficiaries per worker (purple line corresponding to right axis) continues to go up in this intermediate projection through 2095, though at a much slower rate starting in 2035. The higher number of people born each year starting in 1990 who will be in the workforce and the relatively smaller number of people who will be retiring from the baby bust generation allow the ratio to flatten.

What Does This Mean?

Just because the Trust Fund is depleted doesn’t mean there will be more benefits paid. In fact, the current intermediate estimate is that 77% of the benefits can be paid in 2034 from the taxes collected that year.If the assumptions in the intermediate forecast are reasonable, something will have to change. Four options are:

Increase the tax rate. It is estimated that the Trust Fund will stay solvent for at least 75 years if the tax rate is increased immediately from 12.4% (currently split between employers and employees) to 15.18%.

Decrease benefits. Either a 17% reduction in benefits for existing and future beneficiaries or a 21% reduction in benefits for future beneficiaries is estimated to allow the Trust Fund to stay solvent for at least 75 years.

Collect taxes on 100% of wages. Currently, you pay taxes on wages up to the same cap that is used in determining your benefits.

Increase the normal retirement age.

What Does This Mean for You?

Clearly, something will have to change between now and the time Millennials retire and certainly before most of us die. It is unclear what combination of the changes above will be implemented. When I do my retirement planning, I consider two scenarios – one in which I receive my full Social Security benefits using the current benefit levels and one in which I receive no Social Security benefits. I’m sure that what will actually happen will be somewhere between the two, so if I can live without any Social Security benefits (maybe not as nicely as I’d like), I can be more confident of having my desired retirement if I receive some or all of them.

What Determines My Benefits

There are two steps in the formula for determining the monthly benefit you will get if you start collecting benefits at your “normal retirement age.”

Normal Retirement Age

The table below, from the Social Security Administration web site, shows the normal retirement age based on year you were born.

For most of you, your normal retirement age is currently 67. In the remainder of this post, I’ll use 67 as the normal retirement age. If you were born prior to 1960, you’ll need to revise the statements for your normal retirement age.

Data Needed to Apply Formula

The first step in the process requires your total wages by calendar year since you first started working. The Social Security Administration usually sends this information to you every year or you can get the information on line if you are willing to put your social security number in the Social Security Administration’s web site.

As an aside, I always laugh when I get my wage statement. I worked for my father’s company when I was 14. My mother did all the financial reporting and must have reported the $100 of cash wages I made because it appears on my statement!

The Details of the Formula

For each calendar year, the Social Security Administration has determined two numbers: (1) an adjustment factor for inflation between the calendar year and today and (2) a cap on the amount of wages that are considered in the calculation. The maximum amount of wages earned in 2018 considered in the benefit formula is $128,400. The caps going back to 1980 are shown in the graph below.

These amounts and the inflation adjustment factors can also be seen in the table on the second page of this pdf.

In the first step of the calculation, you take the lesser of the wages you earned and the cap for each calendar year. You multiply the result by the inflation adjustment factor for every calendar year.You then figure out the 35 years in which your adjusted and capped wages were the highest. If your wages increased faster than inflation (for example due to merit raises and/or promotions), the most recent 35 years will be the highest. You then calculate your average monthly adjusted wages as the sum of your adjusted wages using the amounts for the 35 years you identified as having the highest values and divide by 420 (the number of months in 35 years).

Currently, your monthly benefit is equal to the sum of:

90% of the lesser of your average monthly adjusted wages and $926.

32% of the lesser of your average monthly adjusted wages, reduced by $926, and $4,657.

15% of your average monthly adjusted wages minus $5,583.

Illustrations of the Benefit Calculation

The maximum monthly benefit you can get if your normal retirement age occurred in 2018 is approximately $3,100. You would receive this benefit if, in at least 35 years during your career, you earned at least the cap (i.e., $128,400 for 2018, divided by the inflation factors for prior years).

Dollar Amounts

The table below shows the monthly benefit you would get at your normal retirement age under a number of assumptions regarding (a) your starting wage and (b) how much more than inflation your wages increased each year, e.g., from job changes, merit raises or promotions.

Percentage of Wages Replaced

To put these values in perspective, the table below shows these benefits as a percentage of the 2018 wages for each of these combinations.

This table shows that Social Security currently replaces between roughly an eighth and a half of pre-retirement earnings, with people earning less having a higher percentage of income replaced than those earning more. Note, though, that people earning less get lower benefits in absolute dollars; they just replace a greater percentage of their pre-retirement earnings.

What if I Start Collecting Early or Late?

The benefit amount that results from the calculations above is what you will get if you start collecting benefits at your normal retirement age. Once you start collecting monthly benefits, they increase in most years for inflation (also, known as the cost of living adjustment). The adjustment is determined by the Social Security Administration based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (known as CPI-W). The graph below shows the cost of living adjustments since 1959.

Age-Based Adjustment Factors

If you choose to start collecting earlier (as young as age 62) or later (as old as age 70), that amount is adjusted. The adjustments are:

For each month you are younger than your normal retirement age when you start collecting benefits, up to 36 months, your benefit is reduced by 5/9 of a percent or 0.56%.

For each additional month you are your normal retirement age minus 36 months, your benefit reduced is further reduced by 5/12 of a percent or 0.42%.

For each month you are older than your normal retirement age when you start collecting benefits, your benefit is increased by 8/12 of a percent or 0.67%.

The table below provides the factors that apply if you start your benefits in your birthday month, assuming your normal retirement age is 67.

Illustration

For example, if the monthly benefit starting at your normal retirement age is $2,500, your benefit if you started at age 62 would be $1,750 adjusted for changes in the cost of living between the year you turned 62 and your normal retirement age. By the time you attained your normal retirement age, you would be receiving 30% (= 1 - 0.7) less than if started collecting your benefits at your normal retirement age.

Similarly, if the monthly benefit starting at your normal retirement age is $2,500, your benefit if you started at age 70 would be $3,100 (= $2,500 increased by 24%) plus changes in the cost of living between the year you turned 67 and your normal retirement age.

If you assume that you can earn an annual after-tax return of 3% on your retirement savings, you are better off starting your benefits at age 62 if you die before you turn 79. If you die after you turn 82 with the same 3% return, you are better off starting your benefits at age 70. As your after-tax return assumption increases, the ages at death increase. At a 6% after-tax return, the ages shift upwards by three years. Of course, none of us know when we are going to die, but might have some indication based on our overall health and family history.

Are Social Security Benefits Taxed?

Determining income taxes on Social Security benefits is complicated. Because my purpose here is to give you an overview, I will provide a slightly simplified version. If you are interested in the details, I suggest contacting your tax advisor or reviewing IRS Publication 915 available on the IRS web site.

The Formula

The first step in determining how much of your Social Security benefits will be subject to tax is to calculate the total of all of your taxable income (e.g., distributions from traditional IRAs and 401ks, taxable interest, dividends and capital gains, and any wages and pension income). In the calculation that determines how much of your benefits are subject to income taxes, you add 50% of your social security benefits to your total taxable income. I will call this total the Test Sum.

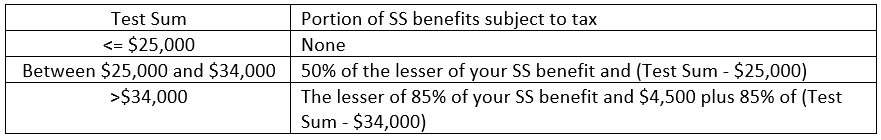

The table below shows what portion of your 2018 social security benefits would be subject to tax based on the value of the Test Sum

Example

Here is an example.

Mary started collecting Social Security benefits in January 2018.

In 2018, she collected $25,000 of Social Security benefits.

She took $23,000 from her Traditional IRA so the sum of her Social Security benefits and IRA distributions equaled 80% of her pre-retirement salary.

Her Test Sum is $23,000 + 50% of $25,000 or $35,500. She falls in the highest category in the table so would pay tax on the lesser of 85% of her Social Security benefit (= $25,000 x 0.85 = $21,250) and $4,500 plus 85% of the excess of Test Sum over $34,000 (= $4,500 + .85 x ($35,000 - $34,000) = $4,500 + $850 = $5,350). Because $5,350 is less than $21,250, she will pay taxes on $5,350 of her Social Security benefit.

If, instead, Mary had no IRA withdrawals and no other income, she would fall in the lowest category in the table and would pay tax on none of her Social Security benefit. At the other extreme, if she had other taxable income of $100,000, she would pay tax on 85% of her Social Security benefit or $21,250.

Next week, I’ll talk about how Social Security benefits affect your decision as to whether to use a Traditional or Roth account for your retirement savings.

[1] https://www.infoplease.com/us/births/live-births-and-birth-rates-year, February 21, 2019.