The Basics of Loans: What You Need to Know

Loans are the financial instruments people use to borrow money. Whether they are getting a mortgage to buy a house, borrowing money to buy a car (as opposed to leasing or paying cash as discussed in this post), or other large purchase, not paying off their credit card in full or borrowing money from a friend, they are taking out a loan. In this post, I will cover the basics of loans, including:

an introduction to the key terms

a description of how loans work

the factors that determine your monthly payment

some common borrowing mistakes

In other posts, I talked about the pros and cons of pre-paying your student loans; more quickly.

The Basics of Loans: Key Terms

There are four basic terms common to almost all loans. They are:

Down payment – The amount you have to pay in cash up front for your purchase. For large purchases, such as homes, condos and vehicles, the lender requires that you pay for part of the purchase immediately. This amount is the down payment. The lender wants you to have a financial interest in maintaining your purchase so it doesn’t lose value (as in the case of a residence) or lose value more quickly than expected (as in the case of a car). For some other types of loans, no down payment is needed. Examples of such loans are student loans, credit card balances and personal lines of credit.

Principal – The amount you borrow.

Interest rate – The percentage that is multiplied by the portion of the principal you haven’t repaid yet to determine the amount of interest you owe. Interest rates are usually stated as annual percentages. They are divided by 12 to determine the interest that is due each month.

Term – The time period over which you re-pay the loan.

The Basics of Loans: How They Work

How the Money Moves

When you borrow money, the lender usually pays a third party on your behalf. For example, when you buy a home or use a credit card, the lender gives the money directly to the seller or its escrow agent. For some loans, the lender gives the money to you, such as with a line of credit. The amount of money the lender gives you or pays on your behalf is the principal.

You then re-pay the loan by paying the lender periodically (usually monthly or bi-weekly). For most loans, you start making payments immediately. For some loans, though, such as student loans and some car loans, you don’t have to make payments right away. Most student loans don’t require any re-payments until after graduation. When entering into a loan that doesn’t require immediate payments, it is critical to understand whether interest will be adding up between the time you enter into the loan and the time you start making payments. Several years of interest, even at a low rate, can increase the amount you need to re-pay substantially.

Part of each payment is the interest the lender charges you for letting you use its money. The rest covers repayment of the principal. For example, if you borrowed $20,000 (the principal) at 5% (the interest rate) and started making monthly payment right away, the lender would calculate the interest portion of your first payment as 5% divided by 12 (months) times $20,000 or $83.33. Your monthly payment also includes some principal. If you have a 10-year term on this loan, your monthly payment will be $212.13. In this case, you will re-pay $128.80 ($212.13 - $83.33) of principal in the first month.

In the second month, you’ll pay interest on $19,871.20 which is the original $20,000 you borrowed minus the $128.80 of principal you paid in the first month. Your interest payment will be $82.80 and your principal payment will be $129.33. Every month, you will pay more principal and less interest. The chart below shows the mix of interest and principal in each of the 120 payments of your 10-year loan.

Factors that Determine Your Monthly Payment

The monthly payment on a loan is a function of three numbers:

Interest rate – the higher the rate, the higher your monthly payment.

Principal – the more you borrow, the higher your monthly payment.

Term – the longer the term, the less your monthly payment.

Sensitivity to Interest Rate and Term

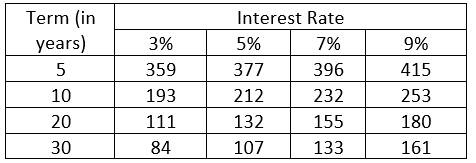

The table below shows the monthly payment on a $20,000 loan for a variety of combinations of interest rates and terms.

The amount of principal for all of the loans in the table above is $20,000. Therefore, when the total amount of your payments increases, it is because you are paying more interest. The table below shows the total amount of interest you would pay for each of the same combinations of interest rates and terms.

Even with the loans with interest rates as high as 9% have much higher payments and total interest than loans with lower interest rates. The interest rates charged on credit cards are often even higher than 9%. This table shows the importance of avoiding the use of credit card debt and refinancing your credit card debt through another lender if it is very large, if at all possible.

What Determines the Interest Rate?

There are several factors that determine your interest rate.

The Economy

The first is the economic environment. If interest rates, such as those on government bonds, are high, the interest rate you will be charged will be also be high. The US government is considered to have almost no risk of not re-paying it loans, whereas individuals have varying levels of risk. The higher the risk that a loan won’t be re-paid, the higher the interest rate. Therefore, most loans to individuals have an interest rate that is higher than the interest rate on a US government note, bill or bond with the same maturity.

Credit Score

Along the same line, your credit score is also an important factor in determining your interest rate. When you have a higher your credit score, lenders believe the risk you won’t re-pay the loan is lower so they charge you a lower interest rate. My post on credit scores provides lots of details on how to improve your score.

Collateral

A third factor in determining the interest rate is whether or not you pledge collateral and how much it is worth relative to the amount of the loan. If you pledge collateral, the lender can take it from you if you fail to make your payments. Examples of loans that automatically have collateral are vehicle loans and mortgages. On those loans, the lower the ratio of the principal to the value of the collateral, the lower the interest rate. That is, if you make a larger down payment on a particular house, your interest rate is likely to be lower than if you make a smaller down payment. Examples of loans that don’t have collateral are credit cards and student loans. When there is no collateral, interest rates tend to be higher than when you pledge collateral.

Co-Signers

Another approach for reducing your interest rate is to have someone with a better credit score co-sign your loan. The co-signer is responsible for making your payments if you don’t. For young people, parents are the most common co-signers.

The Math behind Your Monthly Payment

In this section, I’ll briefly explain the math that determines your monthly payment and will provide a bit of information about the Excel formulas you can use. Feel free to skip to the next section on common borrowing mistakes if you aren’t interested in this aspect of loans!

Present Values

The fundamental concept underlying the determination of the monthly payment on a loan is that the sum of the present values at the loan interest rate of the monthly payments on the day the loan is issued is equal to the principal. A present value tells the values today of a stated amount of money you receive in the future. It is calculated by dividing the stated amount of money by 1 + the interest rate adjusted for the length of time between the date the calculation is done and the date the payment will be received. Specifically, the present value at an interest rate of i of $X received in t years is:

The denominator of (1+i) is raised to the power of t to adjust for the time element.

The present value of all of your loan payments is then:where t is the number of months until each payment and i is the annual interest rate.

Solving for Your Monthly Payment

This amount is set equal to the principal. The monthly payment can be calculated using a financial calculator, such as in Excel, or mathematically. The Excel formula is pmt(i/12, t, X). It will give you the negative of your monthly payment. ipmt and ppmt return the portion of each payment that is interest and principal, respectively. In month y, the interest is ipmt(i/12, y, t, X).

For those of you who really like math, you can also calculate the monthly payment directly. If payments were made forever (an infinite series), the sum above would equal X/i. We need to eliminate the infinite series of payments after the end of the loan to determine the present value of the loan payments. Those payments have a present value of X/i divided by (1+i)term. If we subtract the present value of the payments after the loan term ends from the present value of the infinite series, we get.

That is a bit of a messy formula, but, having gotten rid of the big sum, it can be solved using a fairly basic calculator.

Common Borrowing Mistakes

Some people end up in difficult financial situations, in bankruptcy or even homeless due to poor borrowing decisions. A few of the more common mistakes are identified below.

Not Understanding the Terms

Many mistakes result from not reading or not understanding the loan agreement. For example, some loans (mortgages in particular) have teaser rates or adjustable interest rates. If the interest rate goes up on your existing loan at some point in the future, your payments will also go up. If you have an adjustable interest rate on a loan, you want to make sure you’ll be able to afford higher payments if interest rates increase.Another example of a loan provision that can be problematic is a balloon payment. Under some loans, the monthly payment is calculated as if the loan has a long term, such as 15 or 30 years. However, after a shorter period of time, say 5 or 10 years, the remainder of the principal must be re-paid and the loan terminates. If you haven’t built up enough cash to re-pay the principal or can’t get another loan at a rate you can afford, you might default on your loan.

High Cost of Ownership

Many things that people buy with a loan come with other costs that they haven’t considered and might not be able to afford. For example, when you buy a car, you not only have to make your car payments, but also will need to pay for insurance (including physical damage coverage at a fairly low deductible if required by the lender), gas and maintenance. Similarly, while you may be able to fit your mortgage payment in your budget, you also need to be able to afford the costs of utilities, homeowners insurance and maintenance. In some cases, these additional costs lead to financial difficulties.

Mistakes that Increase Monthly Payments

Some mistakes cause people to have higher payments than necessary. For example, if you take out a personal loan from a bank, you often have the option to post collateral. If you do so, your interest rate is likely to be lower, possibly by as much as 50%.

Another way people end up with monthly payments that are higher than they need to be is to take out a loan that is bigger than necessary. For example, if you can afford to make a larger down payment than you actually make, the principal on your loan will be higher which increases your monthly payment.

Many loans have pre-payment penalties which make it cost-prohibitive to pre-pay your principal to bring it back in line with the amount you should have borrowed in the first place.

Also, if the lower down payment increases the ratio of the principal to the value of your home by too much, it will also increase your interest rate which further increases your payment.

Overestimating the Value of Your Collateral

Another problem people encounter is an inability to borrow as much as they need because they overvalue their collateral. Common issues that arise include:

Lenders get their own appraisals of houses. The lender’s appraisal is often lower than the purchase price and sometimes even lower than the assessed value. If the appraisal is less than the purchase price, the buyer must increase his or her down payment so the ratio of the loan to the appraised value is within the lender’s limits. Even worse, some banks won’t issue the mortgage at all if the difference between the appraisal and the purchase price is too big, even if you increase your down payment. In those situations, you need to either find another lender or re-negotiate your purchase price.

Lenders use the National Auto Dealers Association (NADA) Guides to value used cars. These values can be different from Kelley Blue Book. In particular, the NADA Guides adjust the value based on the specific location of the vehicle. Also, the values in the NADA guides assume that the vehicle is in pristine condition for its age. If it has had any heavy use at all, the lender will reduce the value before determining the value of the collateral.

For used cars, washed titles are also a problem. When a car has been severely damaged, its title is changed from the more typical “clean” title to a salvage title. However, when a car’s title is transferred from state to state, its damage history can get sometimes get lost as some states do not require salvage titles. However, other sources, such as CARFAX, maintain the information about the damage. Lenders will check these other sources before determining the value of the collateral.

While collateral helps reduce the interest rate on your loan, it is important to consider these points in determining the value of your collateral.

Poor Uses of Debt

There are many things for which loans can be used, some of which are valuable and some of which are less so. This post provides a discussion of the characteristics that can help you identify which loans might be good for you.