Debt Calculator: How Much the Snowball Method Will Cost You

The Debt Snowball repayment method will always cost you the same or more interest than the Debt Avalanche method if you have more than one debt and they have different interest rates. The debt repayment calculator in this post will tell you how much extra interest it will cost you.

Debt Payoff Plans

Under the Debt Snowball debt repayment plan, you make the minimum payment on all of your debts except the smallest one. All of the remaining money you have for debt repayment is added to your payment for your smallest debt. That is, you pay off your smallest debt first. When the smallest debt is fully repaid, you pay off the second-smallest debt, and so on. The primary advantage of this approach is that the satisfaction you feel from having paid off some of your debts as quickly as possible.

The Debt Avalanche approach for paying off debt is very similar. The difference is that you add all of your remaining money to the payment for the debt with the highest interest rate instead of the one with the smallest balance. Once that debt has been repaid, you apply your extra payments to the loan with the next lower interest rate. If one of your larger debts has a high interest rate, this approach can save you a lot of interest but it will take a longer time until you’ve fully repaid any one of your debts.

This post provides more information about both methods when there is a big difference in total interest paid and discusses the advantages of each.

Debt Calculator

[If you have a slow internet connection, you might have to wait a minute for the calculator to appear.]

How to Use the Debt Calculator

As a caution, this debt calculator is the first one I’ve written using this platform. Please provide a comment below if you run into any issues using it. I’ve added some tests to make sure your inputs will work, but may not have anticipated every possibility.

Enter Extra Amount

The first amount that you will enter is the amount you can pay in addition to the sum of your minimum payments each month.

Enter Debt Info

The remainder of the information needed by the calculator includes a few key details about each of your debts.

Your outstanding loan amount. This amount will include the total amount of your principal remaining, such as on a mortgage or car loan or the total amount of your purchases on a credit card, PLUS any interest already due that you haven’t yet paid.

The annual percentage rate. This amount is the annual interest rate on the loan entered as a percentage. That is, enter 10 if the annual interest rate is 10%.

The minimum payment. This input is the minimum amount that your lender requires you to pay each month.

The calculator lets you enter information for up to ten debts, but requires that information be provided for at least two debts. These debts can include credit card debt, personal loans, home equity loans, debt from a line of credit, car loans, student loans, and mortgages.

It will give you an error message if you provide information about fewer than two debts or if you provide a principal amount for any debt but are missing one or both of the interest rate and minimum payment.

Some Tips for Entering Data

Here are some tips for entering data in the table:

If you have your data in a spreadsheet, you can copy and paste it into the table.

You can use Tab to move from left to right across a row.

Use Shift-Tab to move from right to left across a row.

You can use Enter to go from one row down to the next.

Be sure to hit Enter or Shift-Tab after you’ve entered the last value in the table. I’ve found the input table to be a bit finicky in that it sometimes doesn’t recognize the last value you have entered.

Doing the Calculations

Once you have entered all of your information, hit the blue Go button.

Data Checks

The debt calculator makes two more checks of your inputs.

First, it checks that the minimum payment on each debt is more than the corresponding monthly interest. If that isn’t the case, your outstanding balance will grow every month even if you don’t make any more purchases.

Second, it checks to make sure that all of your debts are fully repaid in no more than 50 years.

If either of these checks is failed, the debt calculator will indicate which check is the problem. I suggest that you move money from your extra amount to the minimum payment on any loan for which the minimum payment is less than the monthly interest. If your debts will take more than 50 years to be repaid, I suggest increasing the extra amount you will pay to decrease the likelihood that you will die with these debts unpaid.

Interpreting Debt Calculator Output

Sample Input

I created an illustration with the three debts shown in the table below.

In this illustration, I have an extra $50 a month I can use to make payments above and beyond the minimum payments.

Table

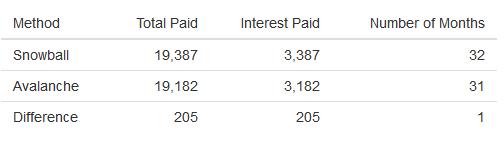

The first output is a table showing the total amount you will pay under each of the Debt Snowball and Debt Avalanche Methods.

It also shows your total interest cost and how many months it will take to pay off the debt.

In this illustration, the Debt Snowball Method will cost you an extra $205 in interest and will take one month longer than the Debt Avalanche Method. The difference in your total payments will always be equal to the difference in interest, as the amount of principal you repay will always be the same under both methods.

Graphs

There is one graph for each method. The colors for the debts are the same in both graphs.

The graphs show the amount you will pay on each debt every month. In this illustration, you put the extra $50 a month towards Debt A in the first 25 months under the Debt Avalanche Method, as it has the highest interest rate. By comparison, you pay the extra $50 a month towards Debt B under the Debt Snowball Method, as it is the smallest. In any given month, the debt on which the extra payment is made is the one shown at the bottom of the chart.

Closing

Everyone needs to decide for themselves which approach to use to pay off their debts. This calculator helps you understand the cost of getting rid of your smaller debts first if that approach is the one that provides you with greater motivation to get out of debt.