A Reverse Mortgage for Retirement Planning

A reverse mortgage can be a valuable financial management tool for seniors and their families. However, if misunderstood or misused, borrowers and their heirs can encounter any one of a number of different challenges.

In this post, I’ll define "reverse mortgage" and provide illustrations of several of its variations. I’ll explain the considerations that determine how much you can borrow. I close this post by identifying the characteristics of people who would or would not benefit from a reverse mortgage and listing many of the risks of reverse mortgages.

What is a Reverse Mortgage?

A reverse mortgage loan lets you borrow money using the equity in your home as collateral. As with all other loans, interest accrues between the time the borrower receives the money and when it is repaid.

In some respects, it is similar to a home equity loan. The main differences between the two types of loans are:

A reverse mortgage does not need to be repaid until the borrower no longer lives in the house. Reverse mortgage borrowers are allowed to repay a portion or all of the amount owed at any time. By comparison, a home equity loan must be paid on a schedule often of five to 15 years.

Only homeowners at least 62 years old are eligible for reverse mortgages. All homeowners, regardless of age who have enough equity in their homes, are eligible for home equity loans.

Interest on reverse mortgages is never tax deductible in the US. Home equity loan interest can be tax deductible, depending on the use of the money.

What are the Options?

There are four ways in which people commonly receive their reverse mortgage proceeds:

A single disbursement.

Monthly payments in a fixed amount for a stated term.

Monthly payments in a fixed amount until the loan is repaid.

In amounts and at times chosen by the borrower, up to a maximum limit. This option is very similar to a home equity line of credit.

Some lenders allow you to combine one or more of these options.

A Single Disbursement

Single-disbursement or lump-sum reverse mortgages are eligible for a fixed interest rate. The homeowner borrows a stated amount from the lender. Interest accrues on that amount until the homeowner no longer lives in the house. For example, a homeowner might borrow $200,000 at a 4% interest rate. The amount that the homeowner or its heirs will owe when the reverse mortgage is repaid will be $200,000 increased by 4% per year. The graph below shows the amount owed based on the number of years until the reverse mortgage is repaid.

The entire amount above $200,000 (blue portion of bars) is the accumulated interest on the loan (green portion of bars).

Fixed Payments

A single distribution can be very helpful when a homeowner needs money for a specific purpose, such as to help a family member, pay for home improvements or repairs, or a short-term medical cost. In many situations, though, homeowners need money regularly to help meet their expenses. In that case, the homeowner can choose to receive a fixed amount of money each month either for a stated period of time or until they no longer live in their home. Reverse mortgages with periodic payments usually have variable interest rates that adjust based on some benchmark rate.

Stated Term Example

A reverse mortgage with fixed payments for a stated term might help a homeowner who wants cash flow to pay off the balance of an existing mortgage or other loan. Once the mortgage has been repaid, the homeowner might not need the additional income.

As an example, let’s say a homeowner needs $1,000 a month for 10 years. To keep the example simple, I’ll assume that the interest rate stays the same over the term of the loan at 4.5%. The graph below shows the amount that will need to be repaid when the homeowner no longer lives in the house.

The total height of each bar represents the amount that would need to be paid if the loan were repaid in each year. The blue portion of the bar corresponds to the amount of money that the homeowner has received from the lender. The green portion of the bar corresponds to the accumulated interest.

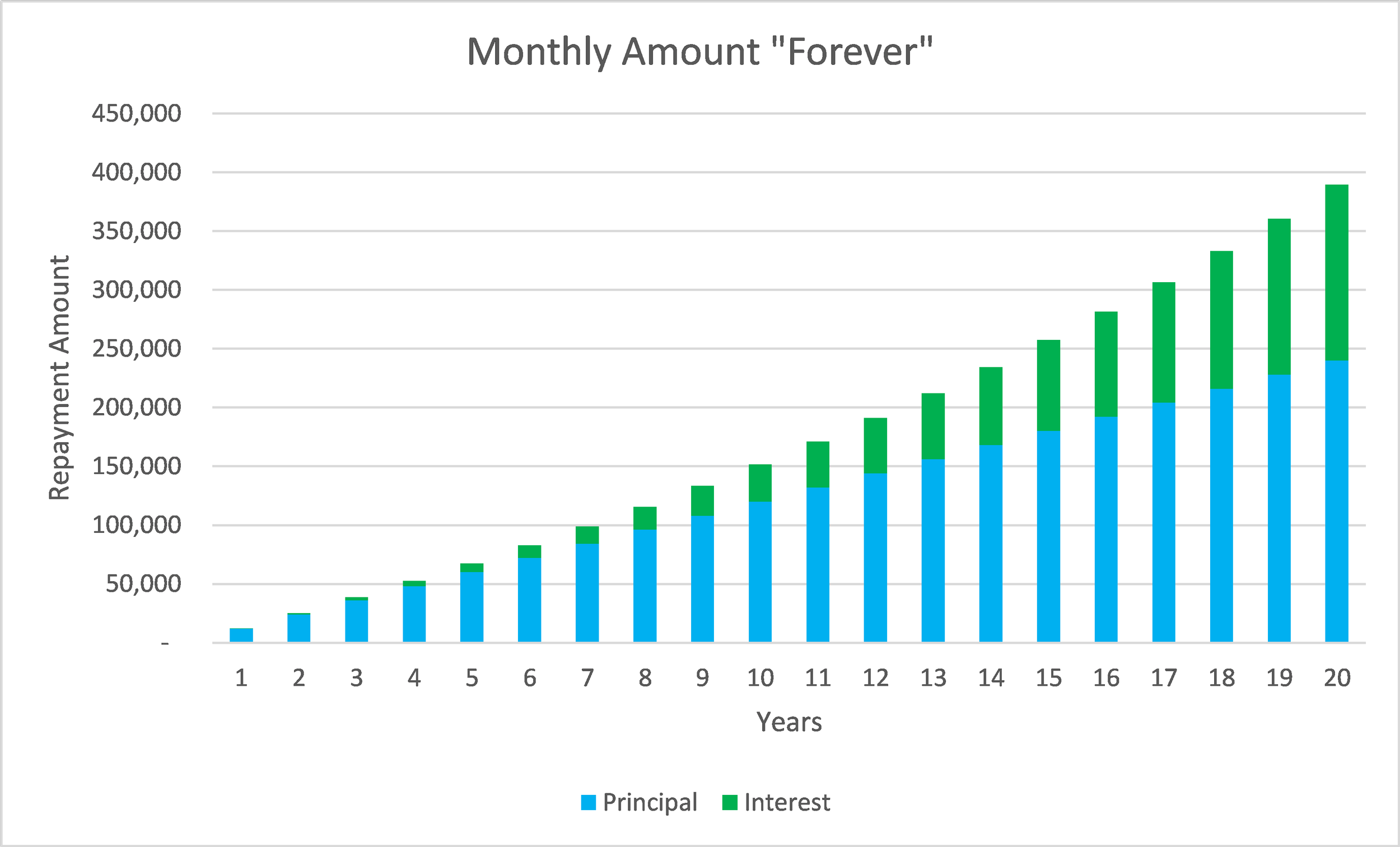

“Forever” Example

A reverse mortgage with fixed payments that continue until the homeowner no longer lives in the house might help a homeowner who wants cash flow to pay on-going living expenses. As an example, let’s say a homeowner needs $1,000 a month indefinitely with 4.5% interest. The graph below shows how the loan balance increases over time.

The first ten years on this graph are identical to the previous graph. After ten years, though, the principal amount increases in this graph, whereas it flattened out in the previous graph. With the additional principal, the interest amount goes up even faster.

Borrow as Needed

If your cash needs are variable, you can borrow from your reverse mortgage at times and amounts that you choose. There is a cap on the amount you can borrow.As an example, let’s say a borrower needs $2,000 every other month, up to a total of $200,000. The graph below shows the total amount owed.

The next graph compares the above example with one in which the borrower is able to repay $500 in the intervening months.

The left bar in each pair shows the amounts owed when $500 is repaid every month. The right bar shows the amounts when there are no repayments. The $200,000 maximum is hit in year 17 in the bars on the right. The yellow portion of those bars stays flat, while interest continues to accumulate. By repaying $500 every other month, the maximum is not reached in the 20-year period shown.

How Much Can You Borrow

The examples above show that the total amount owed on a reverse mortgage can grow rapidly. In the single distribution example, the amount owed exceeded twice the principal by the 19th year. Lenders want to ensure that there is a good-sized cushion between the market value of the home and the amount due when the borrower moves out or dies. As such, the lender creates models similar to the ones I used to make the graphs to estimate the maximum amount that the borrower will owe.

Once it has built that model, it considers the following aspects of the home and the borrower.

The Age of the Youngest Borrower

Lenders generally assume that the loan will not be repaid until the youngest borrower dies. The older the youngest borrower, the shorter the likely time until the loan is repaid. All other things being equal, the lender will loan more to an older borrower than a younger borrower because there is less time for the amount owed to grow.

The Interest Rate

The higher the interest rate, the faster the outstanding balance increases. Therefore, lenders will loan more when the interest rate is lower than when it is higher.

The Equity in the Home

The maximum amount that the lender wants to ever be owed is the amount of equity in the home. If there is no mortgage on the home, then the lender will be willing to have the estimated future total amount owed be equal to something close to but less than the market value of the home. If there is a primary mortgage, the reverse mortgage lender will be paid after the primary mortgage lender. As such, it will only allow the maximum amount it estimates to be owed to be somewhat less than the difference between the market value of the home and the principal remaining on the primary mortgage.

The Ability of the Homeowner to Maintain the House

The lender wants to take every precaution to ensure that the market value of the house doesn’t decrease. It therefore considers whether the homeowner is financially able to keep the house in its current condition. If it has concerns, it will reduce the amount it is willing loan.

The Ability of the Homeowner to Pay Expenses

The lender is also concerned with whether the homeowner is financially able to pay for homeowners’ insurance, property taxes, any homeowners association fees and primary mortgage. If the home is damaged and there is no insurance or not enough insurance, the value of the lender’s collateral goes down. If the homeowner can’t pay its property taxes, homeowners association fees or primary mortgage, the property might be foreclosed eliminating the lender’s collateral. As such, if the lender is concerned about the borrower’s ability to pay these expenses, it will reduce the amount it is willing to loan or not make the loan at all.

Reverse Mortgage Fees

There are more fees involved in a reverse mortgage than most other loans.

The biggest of these expenses is the mortgage insurance premium. Mortgage insurance protects the lender if the outstanding balance of the loan exceeds the market value of the home. It is equal to 2% of the value of the home up front plus 0.5% of the amount borrowed each year. The up-front fee would be $6,000 on a $300,000 home. If the amount of interest and principal outstanding is $100,000, the yearly fee would be $500. The yearly fee increases as interest accumulates and the principal increases.

Reverse mortgages have origination fees paid to the lender that, by law, cannot exceed $6,000 in the US. In addition, the lender can charge servicing fees to monitor and manage the loan and to prepare account statements.

Most borrowers are required to participate in housing counseling before entering into a reverse mortgage. The borrower must pay for this counseling.The borrower will need to pay real estate closing costs, just as if it were selling the home to a third party. These costs can include an appraisal, title search, inspections and all of the other costs involved in selling or purchasing a home.

Who Would Benefit Most?

Retirees

In the right situation, a reverse mortgage can provide significant benefits to retirees. Specifically, people who could find a reverse mortgage to be a great benefit are those who:

Have a lot of equity in their home.

Are healthy enough to think they won’t need to move to a nursing home ever, or at least not soon.

Can’t support themselves on their existing savings and income.

Understand that the loan balance will offset the proceeds of the house when it is sold.

Can afford to pay the ongoing loan fees, property taxes, homeowners’ insurance, homeowners association fees and maintenance after they’ve received the proceeds of the loan.

Alternatives for people in this situation include:

Selling the home and either renting or downsizing. Selling a home and moving involves both financial and emotional costs. In addition, the savings from renting or downsizing might be less than the equity that comes from selling the home.

Selling the home and moving in with relatives. This option will tend to be less expensive for the seniors, but will likely place a financial burden on the relatives. Also, this option is not available to many seniors because family members don’t have extra space or due to tension across generations.

Borrowing money from another source. Not all seniors in this situation have a high enough credit rating or enough income to borrow money without collateral. Even if they are able to borrow money, these debts will reduce the value of the seniors’ estates in the same way as a reverse mortgage.

Older People Getting Divorced

I know of one person who considered using a reverse mortgage during a divorce. In that situation, the husband needed to buy the wife’s 50% interest in the house. The couple had no mortgage on the house. The husband had some money, but not enough to cover the wife’s 50% interest. I never found out whether he used a reverse mortgage for the financing, but I thought it would have been a very creative use of a reverse mortgage.

People who Should Avoid Reverse Mortgages

Indications that a reverse mortgage might not be a good solution for you include:

The terms and conditions of the loan don’t make sense.

You can’t afford the costs.

You might move soon (at which time you need to re-pay the loan) because you are in poor health or other reasons.

It is important to you that you leave the entire value of your home to your heirs.

You have other sources of money to cover your expenses.

Someone, other than your spouse, lives with you who you want to be able to live in the house after you die.

Risks of a Reverse Mortgage

There are many “horror” stories about reverse mortgages. The vast majority of them result from borrowers not fully understanding the terms and conditions of the loan. As with any other financial decision, a reverse mortgage can be a great choice or a terrible one depending on the borrower’s circumstances. The most important consideration, though, is whether the borrower and its heirs understand all of the financial ramifications and risks of a reverse mortgage.

Reduces the Value of Your Estate

Many people do not consider the impact of a reverse mortgage on the value of the borrower’s estate. The outstanding balance of a reverse mortgage acts like any other debt in determining the total value of an estate. The amount heirs will inherit is the difference between a person’s assets and debts. Therefore, as the outstanding balance increases, the value of the estate decreases.

Other than the transaction costs, a reverse mortgage has a similar impact on the value of an estate as dipping into other assets to cover expenses or borrowing money from another source. The former reduces the value of the assets and therefore the value of the estate. The latter increases debts. Therefore, the reverse mortgage, in and of itself, doesn’t reduce the value of the estate. It is the purchases that are made with the money that cause the value to decrease.

Treatment of Spouses

Some couples put the name of only one spouse on the reverse mortgage. If that person dies, the surviving spouse may end up in a challenging financial situation, depending on the terms of the reverse mortgage.In some cases, the house does not need to be sold until the non-signing spouse dies. It is important to read the reverse mortgage documentation carefully if you plan to have the mortgage in only one name.

In most or all cases, the non-signing spouse cannot borrow any more money from the reverse mortgage. If the couple had been using a fixed-payment or as-needed option to cover its expenses, the non-signing spouse will need to find another source of income.

Moving Out of the House

One of the requirements of most reverse mortgages is that the borrower or surviving spouse must live in the house. Some borrowers decide, after entering into a reverse mortgage, that they want to downsize or move closer to a family member. Or, they unexpectedly need to move into a nursing home. A borrower might be caught by surprise if he or she was planning to use the full market value of the house towards a new residence or nursing home costs. Some lenders give a 12-month grace period before the loan needs to be repaid for borrowers who move into a nursing home to sell their homes.

Foreclosure

Reverse mortgages have many conditions with which the borrower must comply to avoid foreclosure. These conditions require you to:

Pay property taxes, any primary mortgage payments and any homeowners association fees on time.

Keep adequate homeowners’ insurance on the home.

Maintain the home to keep it in its current condition.

Live in the home.

Outliving the Amount Borrowed

Many people plan to live on the proceeds from their reverse mortgages for the rest of their lives. Unfortunately, some people spend their loan proceeds before they die. This risk isn’t unique for reverse mortgages, as it exists for many other approaches for savings for retirement, as well. What makes the problem more challenging with a reverse mortgage is that the borrower has already used the equity in his or her home.

Need to Sell House Quickly

The borrower’s heirs must re-pay the reverse mortgage shortly after the death of the borrower. One of my friends has a nephew who ran into a real problem with this issue. He was not aware of this aspect of his parents’ reverse mortgage. He didn’t sell the house as quickly as was required. The bank came very close to foreclosing on the house before he was able to sell it.

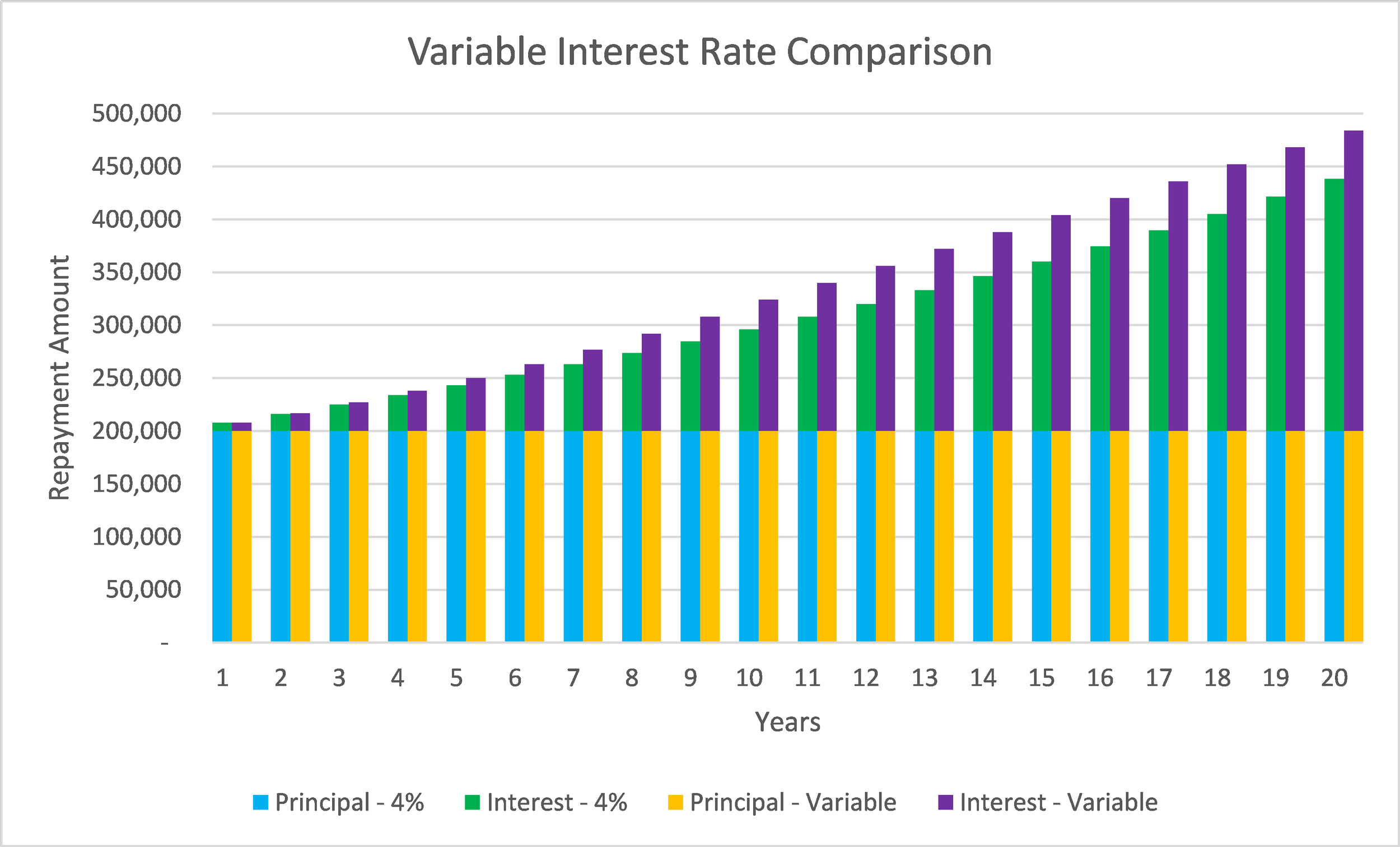

Variable Interest Rates

As with some primary mortgages, many reverse mortgages have variable interest rates. If interest rates increase, the amount owed could increase significantly. The graph below compares the total amount due in each year under the interest rate assumption used above of 4% with the amounts owed in a scenario in which the interest rate increases 0.5 points per year until it reaches 8% for a lump sum principal amount of $200,000.

After 20 years, the interest on the variable rate loan is almost $50,000 higher than on the loan with a constant 4% interest rate.

Closing

There are many more details and options available with reverse mortgages. Investopedia and the Federal Trade Commission are both independent sources for more information. As with any financial transaction, I strongly recommend that you consider a reverse mortgage for yourself or a family member only if you understand all of the details and risks. Reverse mortgages can be very helpful tools in some situations, but horror stories abound.